Contents

Gaining the Courage to Invest

As an accounting student, I was inspired by the movie The Big Short, which tells the true story of savvy financial insiders who capitalized on a disaster no one saw coming. It made the financial community look like sheep running off a cliff. Soon I was “shorting” the market like my heroes, betting against the financial system I distrusted. Since then I’ve learned that cautious optimism makes a much better investment strategy. I’m not smart enough to predict the next crash, nor do I have to be.

It’s been hard to ignore the constant danger signs preached in the media over the past 20 years. Because of that, I spent most of my adult life waiting for the market to crash before I would start buying stocks. I had an irrational opinion that the current growth rate was unstable, even though 10% annual growth is the historical norm! As years went by, and the stock market rallied over and over, I realized I had wasted a golden opportunity to build wealth. That was a painful lesson, but it made me a better long-term investor. I hope you don’t have to learn that lesson the hard way.

In this article, you will learn how an expert investment strategy works, and how it can help you overcome future stock market crashes.

| Read our disclaimer here. |

Stock Market Psychology

Investing can be an emotional roller coaster. Since all investors are human, stock prices contain a mixture of emotions and reality. Luckily, there is a tried and true method to protect yourself: Diversification. You can diversify your investments in two ways:

1. Variety of Investments

Rather than betting your whole life savings on one company (eg. Apple), you’d be safer buying a variety of companies (eg. Apple, Microsoft, Amazon, Facebook, Google).

2. Across Time

Invest the same amount at regular intervals. Investing across good and bad times will help you avoid the effects of emotions in the market. This is called “Dollar-Cost Averaging“.

| Note: I use the S&P 500 in the following examples. It’s an easy way to diversify, and it’s the index I use for my retirement funds. If you want to buy a low-fee S&P 500 index fund from Vanguard, search for the symbol “VOO” in your brokerage app. |

Overcoming Our Financial Trauma

Most Americans are familiar with the financial hardship of the 2000s. Therefore, I thought it would be great to go back in time to test my investment strategy in one of the worst economic times imaginable. Let’s have some fun!

As an example, imagine you started investing in the S&P 500 index right before the end of a market bubble (eg. dot-com bubble of 2000). If you’re like the average person, you had less than a year’s salary saved up. After the market crashed 50%, it got cut in half. You might have thought, “Wow! That’s just my luck. The stock market is clearly not for me. I think I’ll leave it to the professionals from now on.” That would be a huge mistake if you still have years left to work, earn, and save.

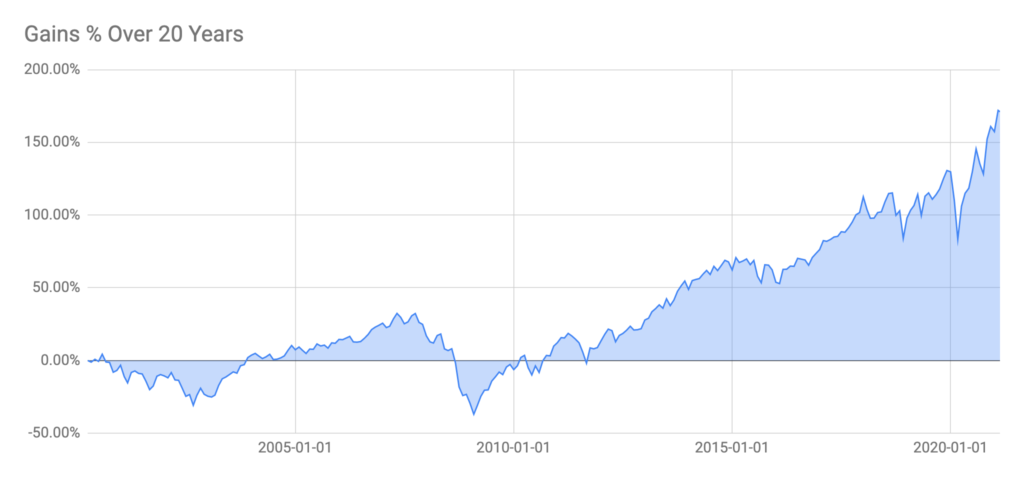

Imagine instead you were very disciplined, and you invested the same amount every month starting April 1, 2000 until February 1, 2021. Now let’s look at what happens over the next 20 years.

Take note of how much time is spent below the zero percent level (breakeven point). It’s surprisingly short considering how severe the economic downturn was. Although it would be challenging, anyone who maintained discipline throughout these turbulent times would have benefited greatly. By 2021, you would have $2.70 for every dollar you invested. You never hear about that on the news!

Why Do Stocks Recover?

Recent market declines haven’t lasted long. The two major crashes in 2000 and 2008 only took a few years to reverse, which made them great buying opportunities. Here are a few reasons why the stock market might recover quickly:

- Businesses continue to create value, grow, and pay dividends

- Governments provide economic stimulus

- Life goes on

Smart Investors Embrace Stock Market Crashes

Investing is about building wealth, so why would one hope for a market crash?

Opportunity!

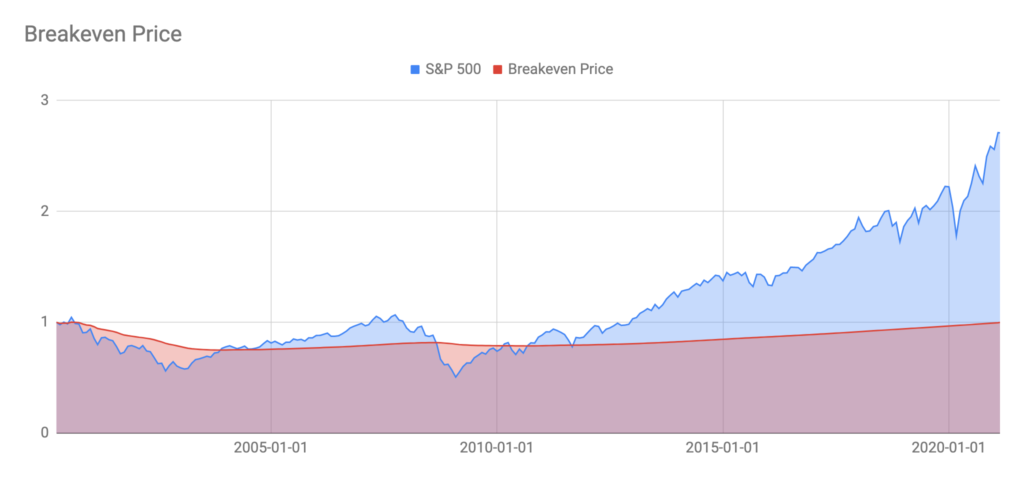

Downturns aren’t all bad. Sometimes it’s a great opportunity to reduce your cost basis, so you can earn more down the road. Think of it as buying stocks on sale. When you’re a buyer, you want the lowest price possible. Let’s revisit our previous strategy to see how this works in real life.

Since we were making monthly contributions, our average cost went down along with the market price. As a result, we broke even long before the market fully recovered!

When is the right time to buy stocks?

Short Answer: Often

Guessing the right time to buy stocks is what financial professionals call “timing the market”. Most people can’t predict the future, even when that’s their job. Timing the market is like gambling. Unless you have some legitimate knowledge of the future, it’s better to form a strategy to deal with uncertainty. A big problem with waiting for crashes is you never know how long you might have to wait. You might waste ten years missing out on huge gains as I did!

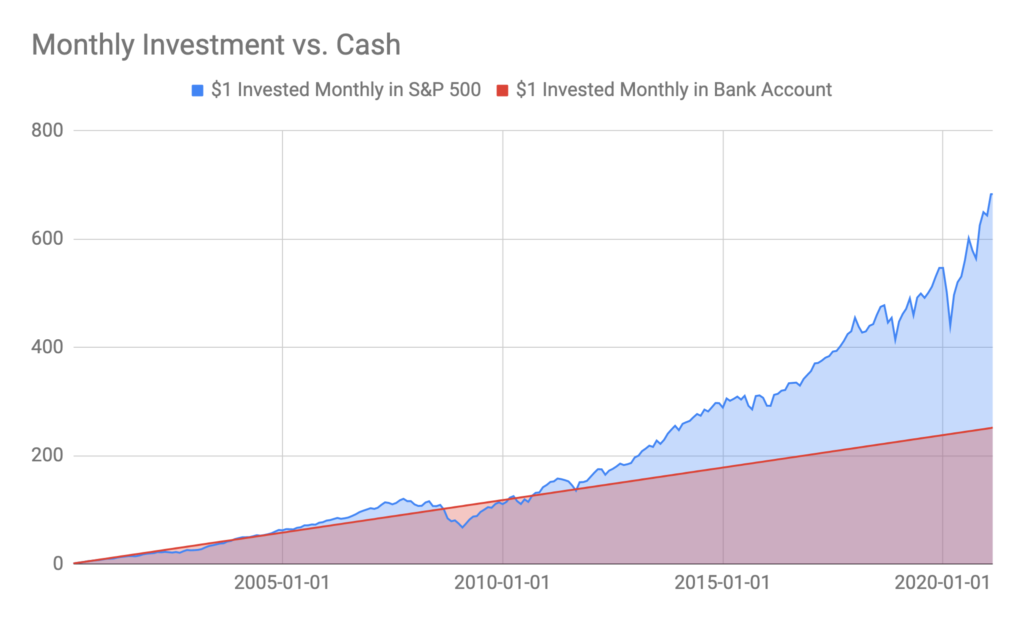

As long as you invest regularly, it’s always a good time to buy stocks. To prove it, let’s look at the difference between buying stocks and saving your money in a bank account over the same 20 year period.

Although cash is a safe store of value, it lacks the huge growth opportunities stocks offer. The effect of compound interest provides exponential growth for stocks. The earlier you invest, the greater this difference can be.

When should I sell my stocks?

Short Answer: Retirement

You might be tempted to cash out your profits by selling your stock. That’s the gambler’s strategy of quitting while you’re ahead. But remember, you’re not gambling. You’re investing, and that requires a different strategy.

Ask yourself, “Am I attempting to predict future market fluctuations?”. If the answer is yes, you should think twice about selling your stock. You should always strive to put your money to its most beneficial use. Remember stocks grow more often than they decline. If you avoid selling until retirement, you’ll maximize your money’s opportunity to grow.

Stock sales can be taxable. Any tax you pay is money that could have been invested. A financial advisor can help you optimize your investment strategy for taxes. It might not seem important now, but you’ll be dealing with big numbers at the end!

Once you reach retirement, you can sell small portions of your stock holdings to fund your living expenses. 4% is widely considered a safe annual withdrawal rate. Smart retirement planning will ensure your investment income covers your cost of living for the rest of your life.

Conclusion

The best time to buy stocks is now! It’s not when you invest that matters. Rather, it’s how often you do it. The US stock market has a good history of surviving bad times. It may take years to recover, but eventually, prices have surpassed the level they were before a crash. Luckily, there is a simple way to use this pattern to your advantage.

A great strategy is to budget a healthy percentage of your monthly income and consistently invest in a broad stock market index such as the S&P 500 (credit to Warren Buffett). It’s so simple, but how many people have the discipline to put it into practice?

I hope this article helps you understand the risks and rewards of stock investing. It’s always important to consider your appetite for risk before you make any big financial decisions. A young person can afford to wait a few years for a market recovery, so I use the strategy outlined in this article to pursue my goals of financial independence and early retirement. If you found this article useful, please share the bliss by clicking below!

[…] Invest regularly in a low fee index fund or retirement account. Seize the power of compound interest. […]

[…] each year, assuming your investments gain more than four percent per year on average. If you invest well, your money should increase faster than you […]

[…] income. Passive income comes from the price growth of the index fund over a long time period. The best retirement strategy is to buy, hold, and ride the market higher over the course of your career. It’s best to […]

[…] rental income and any business activities where the earner does not directly participate. Learning stock investing for beginners can help you grow and manage the wealth that you are about to build. All of my financial decisions […]

[…] balances. That’s because their interest rates are super high. The average annual return on investment the US stock market is around 10%. The average credit card rate is around 20% per year! Therefore, people who run a […]

[…] Wealthy people stay wealthy because they know how to take smart risks with their money. We have another article that explains why the stock market isn’t as scary as it seems. […]