Contents

How Anyone Can Get Rich Quickly

Here’s a fun fact: Teachers can be millionaires – and not by winning the lottery. People around the world are discovering that salary doesn’t determine your wealth. A mediocre salary won’t hinder you from achieving your early retirement dreams. Wealth is actually less about your income, and more about knowing how to use investment vehicles to get there.

Even if you start with no money, it’s still possible to retire in less than 15 years! You just have to save half of your income every year and invest it in assets that generate passive income. Small changes in your spending behavior can drastically change your financial destiny. Before you know it, you’ll replace your work salary with effortless investment income. With a little luck, you’ll be financially free and never have to work for the rest of your life! Read more to find out how to retire early with an average income, and use the calculator at the end to help you plan.

| Read our disclaimer here. |

Retirement Diagnosis

Are you saving enough for your retirement? Most of us haven’t figured that out, so we just save a comfortable amount and hope for the best. There’s a difference between your retirement age and your retirement funds. You’ll need an income source to support your needs no matter your age. Saving doesn’t make you greedy. Today’s decisions will determine whether you’ll be a provider or future burden for others. Keep reading to find out how close you are to retirement, and how simple actions today can speed up your journey to financial freedom.

Motivation to Save

Imagine having the freedom to decline passionless work, or the ability to travel or volunteer whenever you want. It sounds too good to be true, but many have discovered it’s achievable with a little motivation and planning. That’s why retiring early is one of my life goals. It just requires owning investments that give me enough income to cover my living costs, while I spend my time on the activities that bring me the most joy.

Inflation: The Invisible Thief

Let’s assume you don’t trust banks, so you put all your cash savings under a mattress. Even if you saved a regular amount for 40 years, you would only have 10 years worth of savings in the end. That’s because inflation typically cuts dollar purchasing power in half every 20 years. Investing will help you preserve the fruits of your labor, and retire much faster. You should seek investments that provide at least 3% annual return, otherwise you’ll lose value to inflation.

Risks of Investing

If you can’t afford to lose, you can’t afford to win. That’s why the rich get richer. Although 10% is a typical annual growth rate in the stock market, anything can happen in the short term, and you should prepare for the worst. Keeping an emergency fund will help you psychologically manage the ups and downs. If you hold onto your investments all the way through a recession and recovery, you won’t actually lose any money! Alternatively, panic selling when stocks are at a low point is a sure-fire way to lose money.

You can reduce risk by “diversifying” or spreading your investments around. If you have a brokerage app, you can buy a broad index fund such as “VOO”, the symbol for Vanguard’s S&P 500 ETF. That gives you a stake in America’s 500 biggest corporations, with assets and operations all over the world! It’s basically what most financial advisors do after charging you 1% per year in fees. You’re welcome 🙂

Know Your Net Worth, and Why it Matters

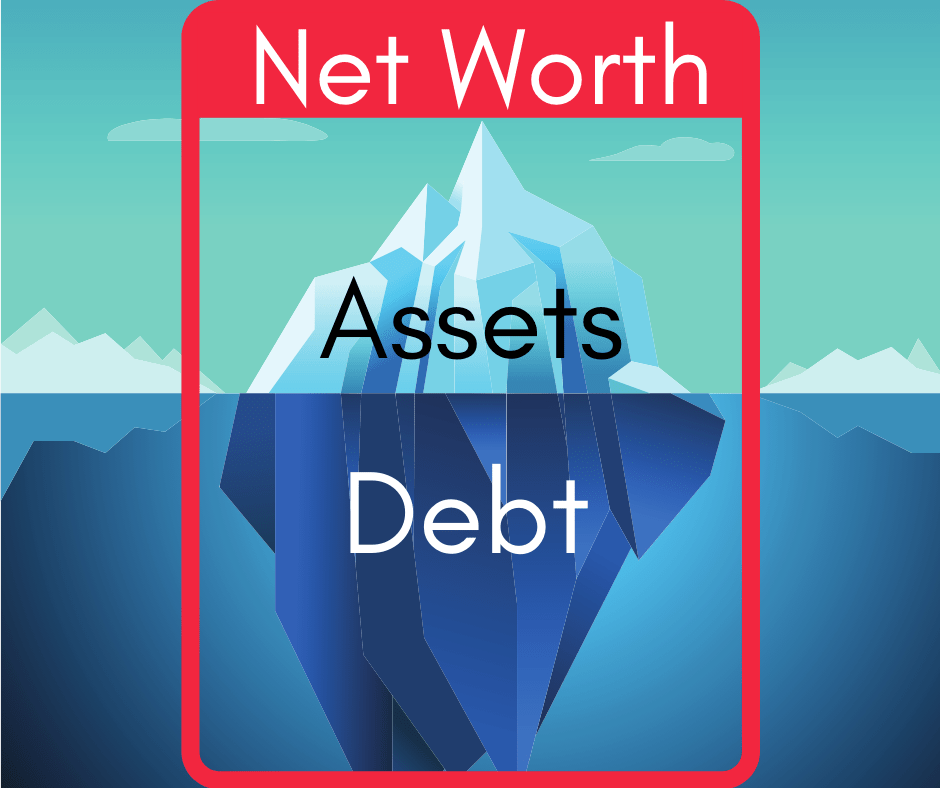

To calculate your net worth, add up the values of assets you own (money, stocks, businesses, houses), and subtract your obligations (loans, mortgages). That’s your true retirement balance today.

Understand the difference between income and wealth. You can be a high earner, while still being enslaved to your job. A big boss CEO can make millions, but he still answers to his investors. Imagine the stress! High income might let you live a luxurious lifestyle and make your friends jealous, but a high net worth gives you priceless freedom and security through passive income. The secret to true wealth is living far below your means, which allows your net worth and passive income to build over time.

Retirement Budget: The 4% Rule

The 4% rule is a common financial guideline to prevent overspending during your retirement. It says you can withdraw four percent of your retirement balance each year, assuming your investments gain more than four percent per year on average. If you invest it well, your money should increase faster than you withdraw. As long as you keep your expenses under control, and stick to the rule, your savings will never run out!

Retirement Goal: 25x Your Current Annual Budget

25x is the total amount you will need for 4% withdrawals to cover your annual expenses. Don’t be afraid of this number though. Compound interest from investments can help you get there quickly.

Here’s how you calculate your retirement goal in 3 easy steps:

- Start with your annual salary

- Subtract your annual retirement contributions

- Multiply that result by 25

Budgeting can help you reduce this number so you can retire faster!

What About Social Security Benefits?

I leave Social Security out of my calculations for two reasons:

- You can’t use it until you’re 62.

- It’s long-term prospects are uncertain.

If you would like to incorporate it, reduce your cost of living estimate by the amount you’ll receive through social security. The US Social Security Administration claims the average American will replace around 40% of their pre-retirement income with Social Security. In that case, you could use 15x instead of 25x to get your retirement goal.

Retirement Example

Here’s an example situation with a person making $50,000 per year:

| Work Salary | $ 50,000 |

| Save 20% for retirement | $ 10,000 |

| Spend the rest on expenses | $ 40,000 |

| Retirement Goal (Annual Expenses x 25) | $ 1,000,000 |

After they achieve their million-dollar goal and retire, they can withdraw 4% each year to support their $40,000 lifestyle. Let’s see how the first year of retirement plays out.

| Day 1 of Retirement: One million dollars invested | $ 1,000,000 |

| Withdrew $ 40,000 to pay for first year expenses | $ 960,000 |

| One Year Later: Investments Grew by 7% | $ 1,027,000 |

This person did no work all year, lived a comfortable lifestyle, and still increased their assets. I hope everyone can experience that kind of bliss!

How Long Will it Take You to Retire?

It all depends on your saving/spending ratio.

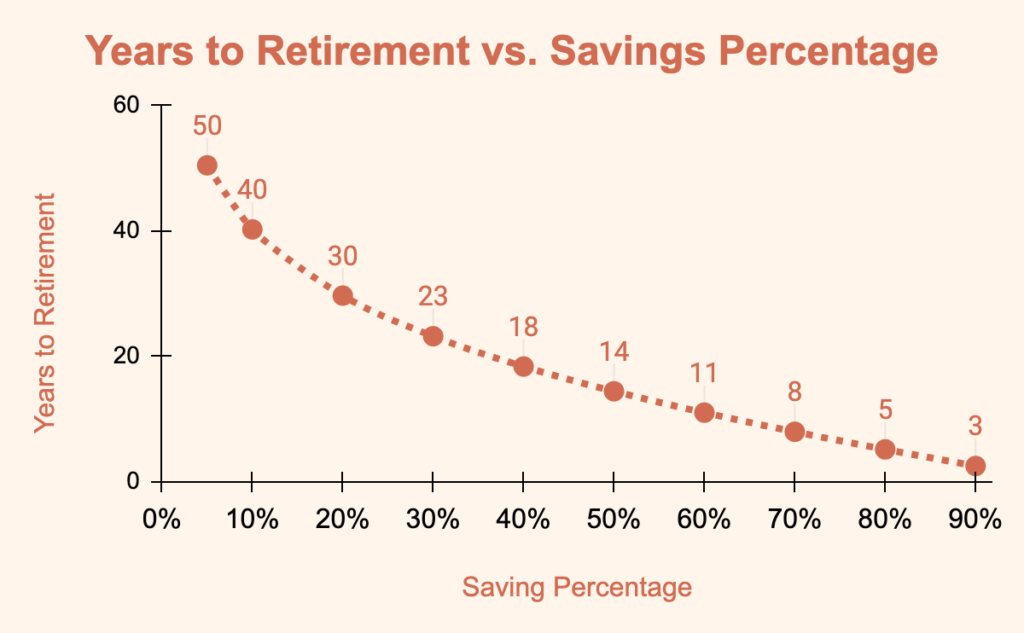

Assuming your savings balance starts from zero and gains 10% per year on average, let’s look at how long it would take you to retire based on different saving habits.

| Saved Portion of Your Paycheck | Years Until Retirement |

| 5% | 50 |

| 10% | 40 |

| 20% | 30 |

| 30% | 23 |

| 40% | 18 |

| 50% | 14 |

| 60% | 11 |

| 70% | 8 |

| 80% | 5 |

| 90% | 3 |

Can you see how steep the curve is at the beginning? Raising your saving percentage from 5% to 20% can reduce your waiting time by 20 years! If you’re investing less than 20% of your income, you have a massive opportunity to reduce your retirement time by saving a little bit more.

How to Retire Faster

It’s super important to minimize your unnecessary expenses. When you cut costs, it reduces your waiting time in two ways.

- Redirects that money to savings

- Lowers your retirement goal (25x annual expenses)

Tips to Reduce Living Costs

- Exterminate Non-Home Debt – It’s the Opposite of Net Worth

- Embrace Modesty – Remember it’s not a Competition

- Cook Quality Food at Home – You’ll Pay Less to Restaurants and Doctors

- Think Critically Within Your Culture – Be the Weirdo Who Takes the Bus

- Eco-Friendly is Often Cheaper

- Use a cash back credit card for expenses, and pay it down each month

- Move to an area with a low cost of living

Tips to Increase Net Worth

- Maximize Your Employer Matching Program – Claim Free Money With 401k

- Don’t hoard cash – Own assets that produce more of it

- Invest in your education to increase your earning potential

- Let your income rise, but not your expenses

Conclusion

Now you know why it’s important to invest your savings. Retirement isn’t some hopeless goal, even for someone with an average salary. If you can live off a smaller portion of your income, you’ll rocket yourself toward financial freedom. I hope this article helped you think differently about your expenditures and take control of your retirement date, instead of walking blind like the average person. Set a date using the calculator below, and share this information with your loved ones!

Easy Retirement Calculator

I designed this calculator to help young people easily understand the importance of investing and budgeting. It assumes zero initial savings and 10% annual return on investments. It should give you an idea of how long it takes to achieve retirement based on different savings habits. You can find more detailed calculators here.

[…] years for a market recovery, so I use the strategy outlined in this article to pursue my goals of financial independence and early retirement. I hope you join me in the […]

[…] regularly will help you build wealth fast. Set a reminder to fund your eToro account with your extra income each month. Then repeat the steps […]

[…] So you can work with the freedom to be responsible with your own time and prepare yourself to save for your retirement. Remember the currency of the new rich is time and mobility. Thanks to the 4-hour work […]

[…] Set time aside to educate ourselves about personal finance. Learn how to build net worth. […]

[…] have a guide on investing for retirement that you should read if you’re a beginner. There are many commission-free brokers and apps […]

[…] who are less lucky, there are other ways to earn your first million dollars which are discussed in another post. Now let’s look at the most popular ways to spend a million […]

[…] for quality communities that provide everything I need. That has allowed me to save more for my retirement, and maybe even extend my lifespan. Now you know the major hidden costs of car ownership. If you […]